Table of Contents

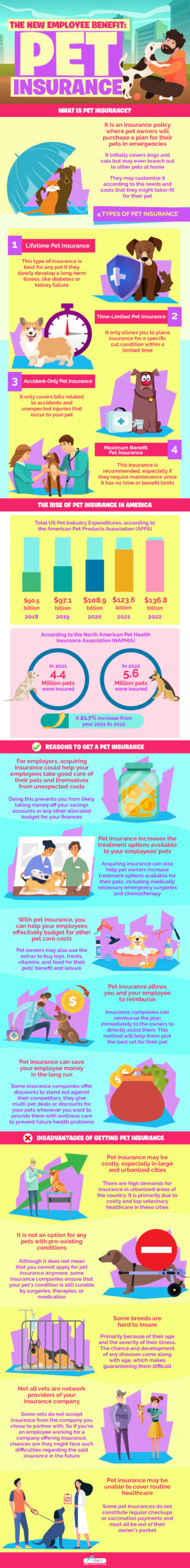

- What Is Pet Insurance?

- The Rise of Pet Insurance in America

- Reasons to Get Pet Insurance

- 1. It protects your employees from any unexpected and unwarranted costs that they might not have foreseen.

- 2. Pet insurance increases the treatment options available to the pet.

- 3. With pet insurance, you can effectively budget for other pet care costs.

- 4. Pet insurance allows you to reimburse.

- 5. Pet Insurance can save them money in the long term

- Disadvantages of Getting Pet Insurance

- Offering Pet Insurance as Employee Benefit: Before You Go…

In recent years, many employers sought out several ways to attract employees—and one of them is by offering pet insurance benefits.

After all, around 66% of households in the USA now include a pet.

That's equivalent to a staggering 86.9 million homes!

Not only is it an effective way to attract more applicants/ potential employees, but I would say it's also possible that most of these employers are pet lovers too.

And frankly speaking, this says a lot about the work culture and the kind of boss you are.

In this article, we will discuss the following:

- what pet insurance is

- the different types of pet insurance

- statistics about the Pet insurance industry

- advantages and disadvantages of getting pet insurance benefits for your employees

So let's get started!

What Is Pet Insurance?

Pet insurance is an insurance policy that pet owners purchase for their pets in case of emergencies.

It initially covers dogs and cats but may even branch out to other pets at home.

Depending on the owner's financial capacity, they can decide what benefits to acquire for their pet's insurance.

They may customize it according to the needs and costs that they might tailor-fit for their pet.

However, since cat and dog illnesses are getting more and more prevalent, most owners procure medical-related insurance, such as accidents, potential injuries, and fatal diseases.

In general, there are four types of pet insurance that one may avail for sustenance:

Lifetime Pet Insurance

This covers an entire lifetime of insurance for your pet.

However, it usually only takes effect per year.

This means it needs to be renewed annually or within schedule.

Lifetime pet insurance is best for any pet if they slowly develop a long-term illness, like diabetes or kidney failure.

Considering that something may happen to your pets at any given age or time, this may come in handy.

Time-Limited Pet Insurance

This type only allows the owner to place insurance for a specific cut condition within a limited time.

It only offers a fixed sum for any possible illnesses or injuries that the pet may have.

Accident-Only Pet Insurance

Accident-only insurance covers bills related to accidents and unexpected injuries that occur to your pet.

Known as the cheapest form of pet insurance, it usually covers scans like the MRI scan and sometimes even operations.

Maximum Benefit Pet Insurance

This is best recommended for pets with long-term illnesses or genetic disabilities.

This insurance is recommended, especially if they require maintenance since it has no time or benefit limits.

The Rise of Pet Insurance in America

Pets create a significant impact on society, and the country is no exception when it comes to taking care of them.

Since they bring us unconditional happiness, it's just fair to pamper, indulge and treat them well in turn.

It isn’t surprising that a pet owner spends more than expected for their furry companions.

Anyone, especially if they own many pets, may not want to hold back in spending for them.

According to the American Pet Products Association (APPA,) in 2022, pet owners spent a whopping $136.8 billion on pet foods, vet care, and supplies, among others.

That's $13.2 billion more than what was spent in 2021 and $27.9 more in 2020 (considering there was the COVID-19 pandemic around this time.)

Check out the most recent report of APPA about the Total Pet Expenditures and the Actual Breakdown of Sales in this link.

Specific to pet insurance, the North American Pet Health Insurance Association (NAPHIA) reported that 5.36 million pets were insured in North America at the end of 2022.

This shows a 21.7% increase from the 4.4 million pets insured in 2021.

and that the pet health insurance marketplace increased by 21.7% from the 4.4 million total pets insured in 2021.

Reasons to Get Pet Insurance

Due to fear of dying, most people don't want to risk themselves and go out.

Besides that, most people also worry about their pets.

Because of the pandemic, many people now realize the importance of health security for themselves and their pets.

This is the main driver of why owners acquire insurance for their pets.

So if you're looking to add this to your employee benefits, below are the other reasons why you should get insurance for your employees' furry friends (and yours, too!)

1. It protects your employees from any unexpected and unwarranted costs that they might not have foreseen.

Your employees with pets might suffer from budget setbacks at times due to unforeseen circumstances such as accidents and injuries.

Thus, you should acquire insurance if things go wrong so you can proceed without worry.

Doing this prevents you from likely taking money off your savings accounts or any other allocated budget for your finances.

If you're an employer, acquiring insurance could help your employees who want to take good care of their companions but struggle financially.

The costs for veterinary bills will be high, and pet insurance will help them ensure excellent pet healthcare.

2. Pet insurance increases the treatment options available to the pet.

Acquiring insurance can also help pet owners increase treatment options available for their pets, including medically necessary emergency surgeries and chemotherapy.

Costly procedures like FLUTD surgery, cruciate ligament surgery, cataract removal, and spinal surgery are also available in your pet’s treatment if ever they need one.

Pet insurance will provide nothing but the best treatment suited for your pets.

3. With pet insurance, you can effectively budget for other pet care costs.

If owners like to buy items for their cats or dogs, the pet insurance policy may help them allocate more.

Since the budgeting aspect for healthcare is gone from the scene, they may purchase useful miscellaneous stuff for their pets.

It may include, but will not be limited to, reallocating the budget for their grooming and vaccinations.

Pet owners may also use the extras to buy toys, treats, vitamins, and food for their pets’ benefit and leisure.

Not only that, but the extras that remain within the budget can be for the owner’s endeavors.

For example, they may use the extra money to buy additional groceries for their everyday living.

4. Pet insurance allows you to reimburse.

There are times when some veterinary clinics do not accept payment from insurance companies.

Or sometimes, a veterinarian declines to treat a pet even though they're the only ones in the town that the insurance covers.

Fret not!

Insurance companies can reimburse the plan immediately to the owners to directly assist them.

Since reimbursement exists within a pet insurance policy, if you're a business owner or an employer, you must expect the owner to receive the payment instead of the clinic.

This method will help them pick the best vet for their pet.

5. Pet Insurance can save them money in the long term

Nowadays, it's difficult to save money due to the rising prices of commodities.

Some businesses weren't even able to rebuild since the pandemic happened!

Since this may be something that pet owners may struggle with, securing them pet insurance in return for employment may benefit both of you.

Some insurance companies offer discounts to stand out against their competitors.

They give multi-pet deals or discounts for your pets whenever you want to provide them with wellness care to prevent future health problems.

In this case, by obtaining pet insurance, you'll be able to save more money in the long run.

Disadvantages of Getting Pet Insurance

If you're an employer planning to propose pet insurance as an employee incentive, bear in mind to make an initial plan.

Why?

Because there might be unforeseen factors involving your own company's financial status that may hinder you from doing so.

Even if the reasons mentioned above can be as good as it gets, like other insurances, pet insurance also has its disadvantages.

1. Pet insurance may be costly, especially in large and urbanized cities.

There is a high demand for insurance in urbanized areas of the country.

This is primarily due to the costly and top veterinary healthcare in these cities.

Thus, if you're an employer, you must thoroughly think if you can afford this type of cost or not.

Because if you don't, you must find other ways to offer them an incentive.

2. It is not an option for any pets with pre-existing conditions.

Suppose you are an applicant hoping to acquire insurance through job applications.

In that case, some insurance companies have problems ensuring pets with pre-existing medical conditions.

Although it does not mean that you cannot apply for pet insurance anymore, some insurance companies ensure that your pet's condition is still curable by surgeries, therapies, or medication.

This approach will also help the company to determine its options and costs for the said insurance.

3. Some breeds are hard to insure.

There might also be cases in which pet insurance companies may reject insuring your pet because of their breed.

It’s not usually because of how exotic they are but more of how many genetic conditions they might present.

Some pets even find it hard to be insured because of their age and the severity of their illness.

The chance and development of any diseases come along with age, which makes guaranteeing them difficult.

4. Not all vets are network providers of your insurance company.

To make matters worse, not all vets accept insurance from the company you chose to partner with.

Pet insurance works typically like usual insurance.

So if you're an employee working for a company offering insurance, chances are you might face such difficulties regarding the said insurance in the future.

The good thing about choosing a suitable insurance company is that they reimburse you directly rather than the vet.

Thus, your employer must choose a company whose policies allow it to be this way so that you won't have problems with finding vets.

5. Pet insurance may be unable to cover routine healthcare.

Lastly, some pet insurances do not constitute regular checkups or vaccination payments and must all be out of their owner's pocket.

The said insurance only serves as a safety cushion or net for the pet's unexpected conditions.

It may also exclude other veterinarian exam fees and even preventive healthcare like spaying and neutering.

Offering Pet Insurance as Employee Benefit: Before You Go…

The best option for a pet insurance company is to look out for those without breed specifications and limits.

You might also want to remember to avoid plans that cost a lot more for preexisting conditions.

If you're an employer planning to entice applicants by offering them pet insurance, bear in mind to become an employer whom they can trust, starting with how you can help them and their pets.

Some owners cannot afford to acquire insurance due to financial problems and instability.

Hence, this tactic can also be used to create intrigue and attract more people to apply.

However, to do this, you must show you're willing to understand, show that you have good intentions, and have a good aura around them.

Pet owners tend to share their pet's empathy and may be able to scrutinize you by how you impress them.

When they realize that you're someone that they can trust, they are likely to think about signing up with you.

Thus, it would be best to take time and slowly introduce the concept of pet insurance to the aspiring employee.

Nevertheless, you must get ready for their decision, especially if it's something that they would like to think about further.

In contrast, if you're a mere pet owner who wants to acquire insurance for their pets, always make sure to do your research and ask other pet owners like you.

Pet insurance can save you not only a lot of money but also a pet's life.

Interested to learn more about pet insurance? Check out our recommended reads below!