Table of Contents

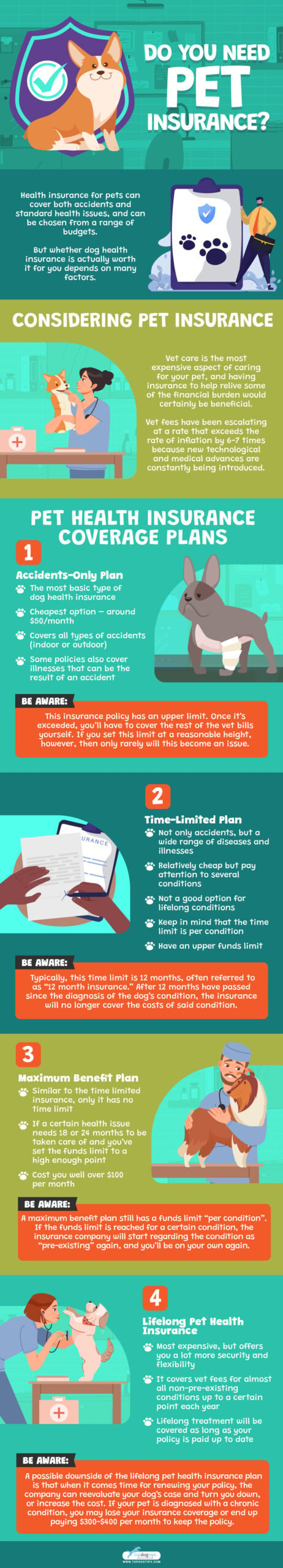

Do you need pet insurance?

I mean, with the continuous increase of prices in commodities, there's just so much our finances can cover.

But as pet parents, it's also important to ensure our dogs' and cats' health.

Pet health insurance has become a billion-dollar industry over the past few years.

More and more insurance companies are now offering pet coverage. And many new insurance companies have popped up that specialize in pet insurance.

Many people struggle to afford health insurance for themselves and the human family members.

So the question is, do you need pet insurance?

Is it worth it to add coverage for your four-legged family members?

What types of policies are available, and which would be best for your pet(s)?

I'll break it all down in this article to help you make a decision.

Do You Need Pet Insurance?

When considering the question, do you need pet insurance, the first thing that will likely come to your mind is the cost of veterinary care.

Vet care is the most expensive aspect of caring for your pet, and having insurance to help relieve some of the financial burden would certainly be beneficial.

Sadly, vet fees have been escalating at a rate that exceeds the rate of inflation. In recent years, the price for vet services has jumped to 10%, according to a report by the Associated Press.

This is because new technological and medical advances are constantly being introduced in the veterinary field.

As with all products and services, the better the quality, the more expensive it is.

Most people don't have thousands of extra dollars set aside in a savings account to pay for emergency surgery or the treatment of a chronic condition for their pet.

They would either need to borrow the money or make the difficult decision to have their pet euthanized.

This is where pet health insurance comes into play.

Cost isn't the only thing to consider in this circumstance.

Whether we like it or not, pet insurance isn’t the miracle solution that insurance companies would like you to think.

There are different insurance plans available, and they all offer different coverage options.

Some insurance companies build loopholes into their policies, so you must be very careful when choosing a policy that will benefit you and your pet.

I'll explain the four most common policy types and the pros and cons of each.

SIMILAR: 19 Tips for Picking the Best Pet Insurance Plans

Types of Pet Insurance: Which One Suits You Best?

1. Accidents-Only Plan

The most basic type of dog health insurance, “accidents only,” is also the cheapest option.

It usually costs around $50/month, depending on the insurance provider and some other factors.

As the name suggests, this insurance covers all types of accidents that can happen to your dog outdoors or indoors.

Some policies also cover illnesses that can be the result of an accident, but you have to research each policy individually to be sure.

This type of dog health insurance is good for pets that go outside a lot and are very active, especially if they do a lot of adventuring off-leash.

If your dog is quite healthy and has a low chance of diseases, genetic defects, and other non-accidental illnesses, this type of insurance can be beneficial.

It will give you a safety net should something unexpected happen.

Cost-wise, accidents-only health insurance plans are affordable on nearly any budget.

BE AWARE: This insurance policy has an upper limit. Once it’s exceeded, you’ll have to cover the rest of the vet bills yourself. If you set this limit at a reasonable height, however, then only rarely will this become an issue.

2. Time-Limited Plan

A time-limited pet insurance plan covers not only accidents but a wide range of diseases and illnesses as well.

They are still relatively cheap because they also have several conditions that you'll need to pay attention to.

BE AWARE: As the name would suggest, these policies have a time limit, usually until 12 months.

Typically, this time limit is 12 months, which is why this type of insurance is often referred to as “12-month insurance.”

After 12 months have passed since the diagnosis of the dog’s condition, the insurance will no longer cover the costs of said condition.

After 12 months, it will be considered “a pre-existing condition,” and even paying for 12 more months of insurance won’t change that.

Because of that, time-limited dog health insurance is not a good option for lifelong conditions like diabetes or arthritis.

Keep in mind that the time limit is per condition.

The fact that 12 months have passed and the insurance will no longer cover your dog’s diabetes doesn’t mean that it won't cover other health issues.

Time-limited plans also have an upper funds limit.

Once that limit is exceeded, even if 12 months haven’t passed yet, you’ll have to pay for the rest of the expenses yourself.

A time-limited dog health insurance policy usually costs less than $100 per month.

3. Maximum Benefit Plan

This type of dog health insurance is similar to the time-limited insurance, only it has no time limit.

If a certain health issue needs 18 or 24 months to be taken care of and you’ve set the funds limit to a high enough point, a maximum benefit plan would be exactly what you need.

This type of plan will cost you well over $100 per month, but it could end up saving you thousands in the long run.

BE AWARE: A maximum benefit plan still has a funds limit “per condition”. If the funds limit is reached for a certain condition, the insurance company will start regarding the condition as “pre-existing” again, and you’ll be on your own again.

4. Lifelong Pet Health Insurance

This type of pet insurance is the most expensive but offers you a lot more security and flexibility than the previous three options.

It covers vet fees for almost all non-pre-existing conditions up to a certain point each year.

Also, if you renew the policy, it will give you the same amount of coverage the following year as well.

With this type of policy, it doesn’t matter how long a treatment can take.

Even if it is a lifelong treatment (e.g., diabetes), you’ll be covered as long as your policy is paid up to date.

If the annual limit is reached, you’ll have to cover the rest until the next year's cycle begins.

Depending on the insurance company you choose, a lifelong dog health insurance policy can cost upwards of $200 per month.

BE AWARE: Upon renewal, some companies that offer lifelong pet health insurance can reevaluate your dog’s case and turn you down or increase the cost. If your pet is diagnosed with a chronic condition, you may lose your insurance coverage or end up paying $300-$400 per month to keep the policy.

Reminders When Choosing a Pet Insurance

Depending on the plan you choose, health insurance for pets can cover both accidents and standard health issues.

You can also choose plans based on your range of budgets.

But whether dog health insurance is actually worth it for you depends on many factors.

It's important that you do your research and shop around with different companies.

Read the fine print, and understand exactly what is and isn't covered by each policy.

Pet insurance companies have been operating without much notice from the government until recently.

Recently, lawmakers have begun looking into bringing more coherence and supervision over pet insurance companies.

There are still a lot of loopholes and tricks, so it's important that you are diligent in your research to make sure you're getting a policy that will cover all of your needs.

Do You Need Pet Insurance? Before You Go…

Not many of us have thousands of dollars in savings that we can spend in an instant should something happen to our pets.

That's why if you have extra cash, it's always better to set aside a couple of dollars every month for pet insurance.

Just remember: always read the fine print, and don't be shy to ask questions!

Want to learn more about pet insurance? Check out our recommended articles below!

Related Articles:

- Does Pet Insurance Cover Vet Visits?

- Does Pet Insurance Cover Pre-Existing Conditions?

- Does Pet Insurance Cover Dental Care?

- Does Pet Insurance Cover Vaccines? Things You Need to Know

- Does Pet Insurance Cover Surgery?

Want To Share…